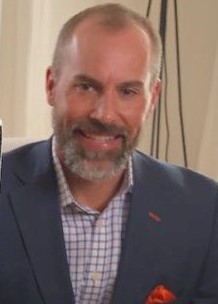

Guy Labbe’ is serving in his second year as instructor assistant in the Senior Bank Management Simulation program. His involvement with the school began much early. He is a 2000 Graduate of GSBS, has served two two-year terms as Trustee to the school for the State of Louisiana, and participated in Bank Sim for the last several years as a judge during final presentations.

Guy graduated from LSU in 1980 with a BS in Finance. From 1985 -1991, he was employed with a consulting firm providing guidance to community banks who were in the process of failing, required assistance to comply with regulatory orders and/or required to augment capital. During the end of this period, his work consisted largely in the representation of banks in the process of acquired failed institutions.

In 1991 he took a position with the local bank in the community in which he grew up. His focus throughout his banking career was to increase shareholder value by maximizing earnings, proper management and leverage of equity capital, and strategic planning. As CFO he led the bank through the financial aspects and regulatory and shareholder approval processes for one branch bank acquisition and two whole bank acquisitions and resulting mergers As CEO and member of the Board of Directors, he provided guidance and direction in a successful transaction in a sale of the bank to a larger local institution.

Guy has been employed for the last five years in a senior consulting role with a community bank in south Louisiana concentrating once again on efficiency, profitability, leverage of capital, and strategic goals. He enjoys the flexibility of his current position and contributing at a high level to the success of the bank.

Guy and his wife, Althea, currently live in and enjoy the food, music, and culture of New Orleans, Louisiana. They enjoy the outdoors, travel and grandchildren.